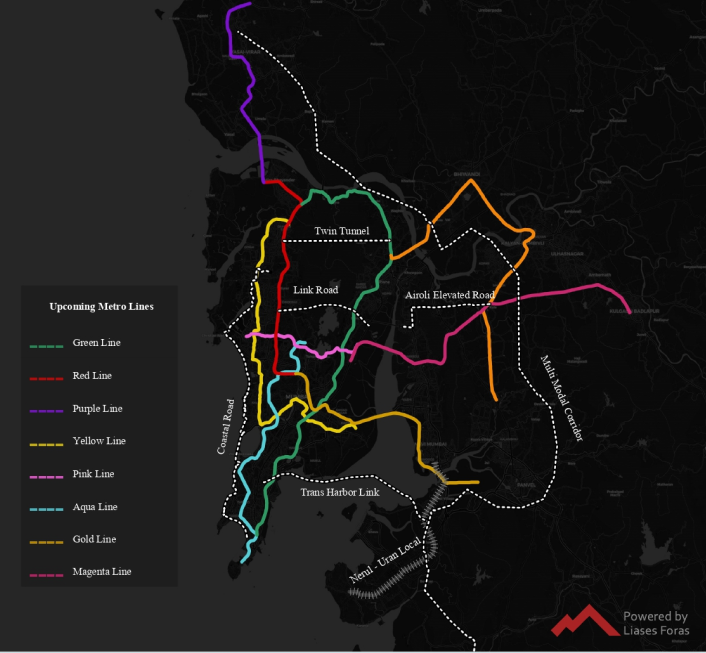

2. Estimated Return Due to Infrastructure Improvement

Evaluates how upcoming infrastructure (e.g., roads, metro lines) may enhance connectivity to employment hubs (CBDs), thereby improving accessibility and property values.

The Investable Score measures how suitable a property is for investment. A higher score indicates a stronger probability of higher returns. It evaluates both the current price efficiency (whether a property is under-, over-, or fairly priced) and its potential for future price appreciation, especially considering upcoming infrastructure improvements.

Evaluates how upcoming infrastructure (e.g., roads, metro lines) may enhance connectivity to employment hubs (CBDs), thereby improving accessibility and property values.

| Rating | Score Range | Interpretation |

|---|---|---|

| Outstanding | >700 | High return |

| Excellent | 551–700 | Strong return potential |

| Good | 401–550 | Above-average investment |

| Average | 301–400 | Moderate return |

| Below Average | 201–300 | Limited return |

| Poor | <200 | Low return |