The analytical models for predicting the price are based on years of research in

decoding the science of the property's price. The two theories, the urban price setting

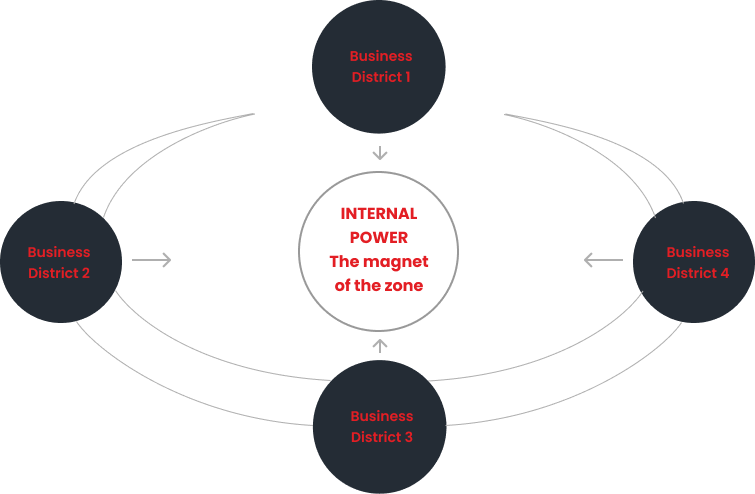

model, predicts the current price of the property, and the magnet theory ascertains the

future trajectory of the property prices.

Two core models govern this framework:

- Urban Price Setting Model – Predicts the current price of a property.

- Magnet Theory - Projects the future price trajectory.

Urban Price Setting Mode

The

Urban Price Setting Model

is a proprietary framework developed by Liases Foras after over two decades of research on real estate price dynamics.

It simulates how prices are set across an urban landscape and predicts the prevailing property prices.

Core Principle:

A property’s price is governed by four key factors:

- "Distance" (proximity to core areas or CBDs)

- "Density" (economic or demographic concentration)

- "Surrounding" (geographical and environmental attributes)

- "Product" (quality and specifications of the property)

A multivariate regression model integrates these variables to predict property prices with high precision, capturing geospatial variations and product differentiation.

Rationale:

- Every product (real estate asset) has a distinct value within a specific space.

- The same product’s price varies based on its spatial dynamics location, density, and neighborhood quality.

- Each city maintains aunique price equilibrium at any given point in time.

- When prices change in one micro-market, it resets the equilibrium, influencing other surrounding areas and forming a new citywide price structure.