Annualized Return Distribution

1.7k+

All propertiesDistance, Density, Surroundings, and Product are converted into data vectors, making it easier to evaluate each property's return on investment (ROI) and risk level.

Annualized Return Distribution

Distance, Density, Surroundings, and Product are converted into data vectors, making it easier to evaluate each property's return on investment (ROI) and risk level.

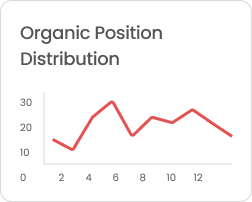

Organic Position Distribution

Exploring listings based on budget, location, and preferences.

Exploring listings based on budget, location, and preferences.

Exploring listings based on budget, location, and preferences.

Modern 3BHK Apartment

Luxury Villa with Private Garden

Desktop valuation uses India’s first AVM (Automated Valuation Module) along side verified primary and secondary data sources for accurate value assessments.

No subjective intervention; valuation is conducted entirely online.

Provides quick property or asset evaluations, saving time compared to traditional methods.

Predicting future price appreciation influenced by improving infrastructures and commutation time in the city along with current price productivity.

Giving you context on relative grade of locality and determining neighbourhood profile of the project’s location.

A score indicating the return probability of a project.

Read & Accept the terms & conditions before proceeding to pay.

Stress testing report will be delivered to you with three working days at your registered email-id

Estimates short-term asset value based on recent market data and economic conditions to guide buy/sell decisions.

Projects long-term asset value using trends and historical performance for investment planning.

Indicates minimal investment risk based on stability, ensuring consistent returns with low volatility.

Measures average income of area residents — influencing real estate values and lifestyle trends.

Rates areas by accessibility, safety, amenities, and environment — higher scores mean better livability.

Evaluates developer reliability through quality, timelines, and customer satisfaction records.

Assesses project implementation risk — including cost overruns and deadline delays.

Analyzes urban price dynamics based on supply, demand, and consumer preferences.

Suggests prices are attracted to equilibrium points influenced by market momentum and sentiment.

Proven to be best in predicting and analyzing Real Estate Market trends.

Non Broking and Independent Reality Research Company. Trusted by the most credible institution

Property Science by Liases Foras, India's largest real estate data and market experts.

Presence in industry

Unified India's real estate data with infrastructure, demographics, and analytics tools via engineering.

Tracking of 20,000+ live projects through field survey

Listing data of 1million properties.

Up-to-date mapping of 5 million legal transactions.

Data of all RERA registered projects.

Tracks new construction and builder-supplied properties entering the market. This data provides insight into current supply trends, upcoming project launches, and the overall health of the real estate sector.

Provides information on previously owned properties available for resale. This data helps identify trends in secondary market activity, demand for pre-owned homes, and the influence of resale inventory on property prices.

Records all officially registered real estate transactions. This data offers a clear picture of market activity, including transaction volumes, buyer and seller behavior, and the legal status of property deals in the market.

Covers currently operational infrastructure, such as roads, utilities, and public services. Understanding this helps assess how well-developed areas are, influencing real estate demand, accessibility, and long-term value for investors.

Focuses on future infrastructure projects, such as planned highways, metro lines, or new utilities. These developments often trigger price appreciation and enhance desirability, making areas more attractive for both buyers and investors.

Analyzes population growth and density trends in specific regions. Population data influences demand for housing, commercial spaces, and public infrastructure, making it essential for predicting market needs and future development opportunities.

Segments the population based on income levels, helping identify potential buyers and their purchasing power. This classification is critical for targeting the right market and developing properties suited to various income groups.

Measures the wealth distribution across different regions. This index helps assess the demand for premium properties, luxury housing, and high-end developments, indicating areas with affluent buyers and potential for upscale projects.

Provides data and trends on real estate markets within different cities. This includes urbanization rates, development opportunities, and regional economic growth, helping investors and developers target cities with high potential for growth.

Focuses on smaller, localized real estate markets within cities. Each micro market has unique characteristics, demand drivers, and price dynamics, offering niche opportunities for investment and tailored real estate strategies.

Offers detailed information on individual real estate developments, including size, scope, location, and status. Tracking projects helps investors understand supply dynamics, ongoing trends, and the types of properties available in specific regions.

Highlights key real estate developers and their ongoing projects. Developer data is vital for assessing project quality, reliability, market reputation, and the likelihood of timely completion, which impacts buyer confidence and investment decisions.

Reach out to our team of experts and let's discuss how we can work together to achieve your goals.

Contact Us